The D.C. area earned its position near the top due to its large metropolitan area with more universities and industry players

Article originally published by Washington Business Journal on July 14, 2022

Greater Washington’s life sciences cluster just got the silver medal for talent, beating out other major hubs, including one of its biggest rivals, in a moment of critical growth for the local industry.

The D.C. metro ranks second only to the Boston-Cambridge region, notably edging out the San Francisco Bay Area, in a new report from commercial real estate services firm CBRE examining the state of the life sciences workforce across the country. It’s a key boost for this region, which has aimed for decades to become a premier destination for the rapidly growing life sciences sector, particularly during the pandemic, and its highly educated, highly paid jobs.

The ranking of the top 25 life sciences research talent clusters in the first quarter pegs the Bay Area at No. 3, New York-New Jersey at No. 4 and San Diego at No. 5.

The D.C. area earned its position near the top because it’s a larger metropolitan area with more universities and industry players, giving it an “abundant talent pool for life sciences companies,” the report said. That was also the case for markets such as Los Angeles (No. 7), Philadelphia (No. 8) and Chicago (No. 10). The bottom of the top 25 includes Portland, Oregon; Miami; Nashville, Tennessee; Albany, New York; and Pittsburgh.

The study also found that the life sciences ecosystems “more broadly thrive” in regions that house more people who hold doctorate degrees. To that end, Greater Washington has an advantage as the search for talent becomes tougher in life sciences, which in April claimed the second-lowest unemployment rate at 0.6%, according to CBRE’s report. At the same time, the D.C. region may also be seen by competing markets as a recruitment source, given its higher cost of living.

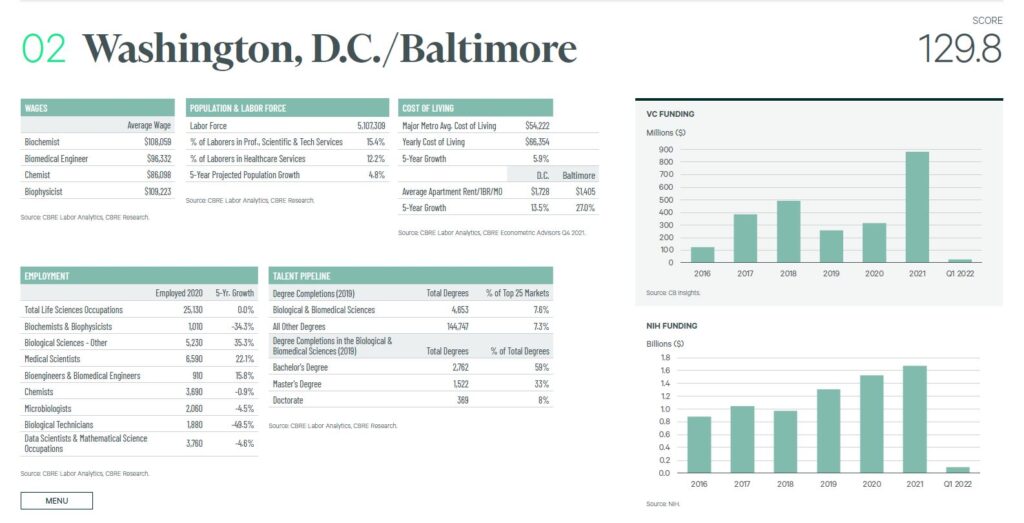

The region’s labor force counts more than 5.1 million people, of which 15.4% work in professional, scientific and technical services, and 12.2% hold roles in health care services, according to CBRE data.

The D.C. area’s life sciences community has seen substantial growth and attention through the pandemic as local companies jumped into the health crisis response. The pandemic generally boosted funding and support for manufacturing, research and development for vaccines, therapies and testing. And that directly benefited multiple resident companies working in and around Covid-19.

But the CBRE report also notes that people moving from major cities to some smaller pockets of the U.S. during the pandemic in 2020 “may have disproportionately, and temporarily, dampened the growth of such key markets,” including the Washington-Baltimore corridor.

Still, we’ve seen relentless activity from the region’s companies, particularly in Montgomery County’s talent-rich and saturated Interstate 270 corridor. Gaithersburg’s Novavax Inc. (NASDAQ: NVAX) led the pack as a vital player in the global effort to bring a Covid vaccine to market — and, after a long road, received emergency use authorization for the product Wednesday, making it the fourth to do so in the U.S.

The D.C. area has also attracted more biotech and life sciences firms to put down roots, with the National Institutes of Health and the Food and Drug Administration as obvious baked-in draws to the nation’s capital. The local contingent of companies continues to see approvals, funding, sales and public debuts. Lab space has also become a more reliable niche of the region’s otherwise uncertain real estate landscape.

Those dynamics are important, according to the report, which said the availability of venture or institutional capital “to fund growth is essential to a thriving life sciences ecosystem,” as is “the need for proper infrastructure for an ecosystem to grow, such as modern laboratory, incubator and manufacturing space.”

To narrow down the ranking, CBRE looked at the country’s 74 largest life sciences labor markets, considering occupational and educational data, as well as number and market density of relevant industry jobs, and concentration of doctorate degrees and professional, scientific and technical employment.

The analysis considered the jobs most relevant to the industry’s growth and people graduating with relevant degrees in those markets. And it weighed those scores against data from the normally dominant Boston, San Francisco and San Diego areas — which CBRE described as “premier life sciences hubs” that “likely reflect the most ideal elements for success as a life sciences cluster.”